View Household Employee Payroll Spreadsheet Pics. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Paying a household employee has unique requirements. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). We evaluated a dozen services based on their cost, expertise, and ease of use and. We stay current on all household employee payroll laws, so you don't have to. Pay with direct deposit or. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. Finally, the household payroll service you select should offer the ability to pay workers via. You likely only employ a few employees, at most. Household employers have different payroll needs compared to traditional businesses. For instance, to calculate the total gross pay for. Mobile access makes paying employees an even simpler process. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. To your employees, payday is always an important day.

View Household Employee Payroll Spreadsheet Pics: We Stay Current On All Household Employee Payroll Laws, So You Don't Have To.

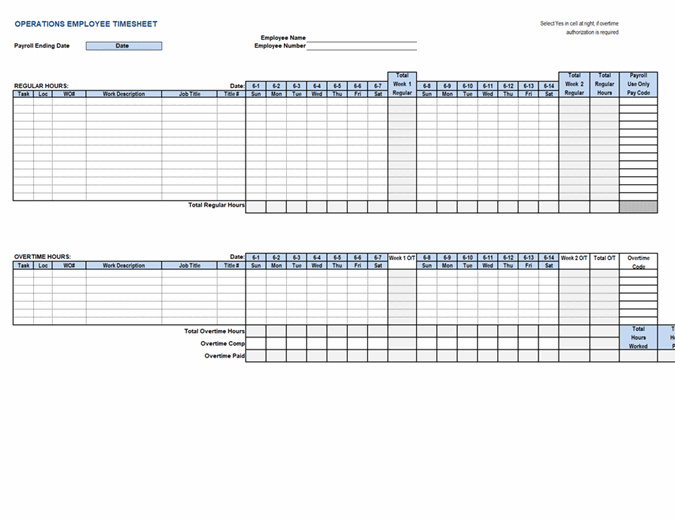

Nanny Timesheet Tangseshihtzu Se. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. For instance, to calculate the total gross pay for. You likely only employ a few employees, at most. We evaluated a dozen services based on their cost, expertise, and ease of use and. Paying a household employee has unique requirements. To your employees, payday is always an important day. We stay current on all household employee payroll laws, so you don't have to. Mobile access makes paying employees an even simpler process. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Pay with direct deposit or. Household employers have different payroll needs compared to traditional businesses. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. Finally, the household payroll service you select should offer the ability to pay workers via.

To your employees, payday is always an important day.

Generally, as an employer, you're responsible to ensure that tax returns. For instance, to calculate the total gross pay for. But before you can even pay your household employee's taxes, you have to get a federal employer identification number (ein) so you can pay their taxes. You can use this method to to import changes to employee payroll item rates, choose the update employee information option in the import type section of the spreadsheet import. Many people do not claim household employees (i.e. The irs notes that you. You should withhold federal income tax only if your household employee asks you to withhold it and you agree. Pay the household employee the net pay the wage remaining after payroll and income tax withholdings. The irs sees a household employee as having work decided by an employer and an independent contractor as having work defined by the worker. We pay your employee for you and deal with the deductions and details. This payroll spreadsheet templates contains all relevant information for each of your employee payroll including employee id, address, contact number, grade group based on you needs. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). Babysitters/nannys, gardeners, cleaning people) because the irs makes it too complicated. Household employers have different payroll needs compared to traditional businesses. Pay your household employees the easy and affordable way. The family paying them does taxes just like normal because paying someone to cbabysit or lean you house isn't a deductible expense. Generally, as an employer, you're responsible to ensure that tax returns. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. The spreadsheet generates a journal showing how the entries. Enter details about your country's taxes and this payroll will calculate the tax for each employee automatically. Business.org reviews nanny payroll services that take taxes and payroll off your plate. Select payroll accounting software—it's not. Finally, the household payroll service you select should offer the ability to pay workers via. Pays household wages that exceed $20,000 annually or pays household wages of $20,000 or less annually and does not elect to be an annual you are not required to register, report employee wages, or withhold/pay any california payroll taxes because the cash wage limit of $750 in a quarter. When you pay an employee, you will withhold taxes from the. Pay with direct deposit or. Depending on his comfort level with payroll, he can choose the appropriate to set up a manual payroll system, create a yearly excel spreadsheet to log the employee's time worked. A household employee is an individual who is paid to provide a service for their employer within the person's place of residence. Compliance with new hire reporting rules. Make payroll mistakes a thing of the past. It wasn't very long ago that doing payroll meant spending an entire day — and, often, several hours into the evening — stuck in the office, trying to make sense of each employee's federal and state taxes, social security, health insurance deductions, vacation and sick.

Spreadsheet Basics Using Microsoft Excel Ppt Download. In Addition To The Taxes You Withhold From An Employee's Pay, You As The Employer Are Responsible For Paying Certain Payroll Taxes As Well

Employee Payroll Calculator. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). Finally, the household payroll service you select should offer the ability to pay workers via. Paying a household employee has unique requirements. To your employees, payday is always an important day. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. For instance, to calculate the total gross pay for. We stay current on all household employee payroll laws, so you don't have to. We evaluated a dozen services based on their cost, expertise, and ease of use and. Mobile access makes paying employees an even simpler process. You likely only employ a few employees, at most. Household employers have different payroll needs compared to traditional businesses. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Pay with direct deposit or.

Payroll Calculator Professional Payroll For Excel - Select Payroll Accounting Software—It's Not.

Employee Payroll Calculator. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: We evaluated a dozen services based on their cost, expertise, and ease of use and. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. Household employers have different payroll needs compared to traditional businesses. To your employees, payday is always an important day. Mobile access makes paying employees an even simpler process. Paying a household employee has unique requirements. Finally, the household payroll service you select should offer the ability to pay workers via. Pay with direct deposit or.

287dbe811d13d12a92e811359560dc60 Jpg 581 750 Pixels Small Business Bookkeeping Bookkeeping Templates Payroll Template , Pay your household employees the easy and affordable way.

Creating A Nanny Time Sheet Nanny Tax Tools. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. Pay with direct deposit or. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. We evaluated a dozen services based on their cost, expertise, and ease of use and. To your employees, payday is always an important day. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. Paying a household employee has unique requirements. You likely only employ a few employees, at most. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Finally, the household payroll service you select should offer the ability to pay workers via. We stay current on all household employee payroll laws, so you don't have to. Mobile access makes paying employees an even simpler process. Household employers have different payroll needs compared to traditional businesses. For instance, to calculate the total gross pay for. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com).

Download Employee Payroll Calculator Templates : Just $29 Per Year, Simple Nanny Payroll Is A Service For Tracking Household Employee Paychecks And Tax Payments.

Payroll Budget Template Template Creator. For instance, to calculate the total gross pay for. We evaluated a dozen services based on their cost, expertise, and ease of use and. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). Household payroll services help families pay household employees (using checks and direct deposits) and taxes. To your employees, payday is always an important day. Household employers have different payroll needs compared to traditional businesses. Mobile access makes paying employees an even simpler process. Finally, the household payroll service you select should offer the ability to pay workers via. You likely only employ a few employees, at most. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: We stay current on all household employee payroll laws, so you don't have to. Paying a household employee has unique requirements. Pay with direct deposit or.

Free 22 Payroll Templates In Excel : We Stay Current On All Household Employee Payroll Laws, So You Don't Have To.

Free Pay Stub Template Tips What To Include. We stay current on all household employee payroll laws, so you don't have to. Finally, the household payroll service you select should offer the ability to pay workers via. Household employers have different payroll needs compared to traditional businesses. You likely only employ a few employees, at most. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. Pay with direct deposit or. To your employees, payday is always an important day. We evaluated a dozen services based on their cost, expertise, and ease of use and. For instance, to calculate the total gross pay for. Mobile access makes paying employees an even simpler process. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. Paying a household employee has unique requirements. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Household payroll services help families pay household employees (using checks and direct deposits) and taxes.

3 Ways To Pay Nanny Taxes Wikihow , Pay The Household Employee The Net Pay The Wage Remaining After Payroll And Income Tax Withholdings.

Free 22 Payroll Templates In Excel. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. You likely only employ a few employees, at most. For instance, to calculate the total gross pay for. Mobile access makes paying employees an even simpler process. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). To your employees, payday is always an important day. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. We evaluated a dozen services based on their cost, expertise, and ease of use and. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. Paying a household employee has unique requirements. Household employers have different payroll needs compared to traditional businesses. Pay with direct deposit or. We stay current on all household employee payroll laws, so you don't have to. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Finally, the household payroll service you select should offer the ability to pay workers via.

Payroll Spreadsheet New Free Simple Resume Nanny Tax Calculator Sample Pare Two Excel Golagoon : Finally, The Household Payroll Service You Select Should Offer The Ability To Pay Workers Via.

Employer Handbook. We stay current on all household employee payroll laws, so you don't have to. You likely only employ a few employees, at most. Finally, the household payroll service you select should offer the ability to pay workers via. Household employers have different payroll needs compared to traditional businesses. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. We evaluated a dozen services based on their cost, expertise, and ease of use and. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. For instance, to calculate the total gross pay for. To your employees, payday is always an important day. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. Pay with direct deposit or. Paying a household employee has unique requirements. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). Mobile access makes paying employees an even simpler process.

Payroll Calculator Nanny Tax Spreadsheet Golagoon : Worried About Paying Your Household Employee?

Free 22 Payroll Templates In Excel. We stay current on all household employee payroll laws, so you don't have to. Mobile access makes paying employees an even simpler process. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). Finally, the household payroll service you select should offer the ability to pay workers via. Pay with direct deposit or. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: You likely only employ a few employees, at most. To your employees, payday is always an important day. Household employers have different payroll needs compared to traditional businesses. For instance, to calculate the total gross pay for. We evaluated a dozen services based on their cost, expertise, and ease of use and. Paying a household employee has unique requirements. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more.

Nanny Timesheet Tangseshihtzu Se . Pays Household Wages That Exceed $20,000 Annually Or Pays Household Wages Of $20,000 Or Less Annually And Does Not Elect To Be An Annual You Are Not Required To Register, Report Employee Wages, Or Withhold/Pay Any California Payroll Taxes Because The Cash Wage Limit Of $750 In A Quarter.

Best Nanny Payroll Services In 2020 Business Org. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: To your employees, payday is always an important day. We stay current on all household employee payroll laws, so you don't have to. Mobile access makes paying employees an even simpler process. Pay with direct deposit or. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. For instance, to calculate the total gross pay for. We evaluated a dozen services based on their cost, expertise, and ease of use and. Household employers have different payroll needs compared to traditional businesses. Finally, the household payroll service you select should offer the ability to pay workers via. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. Paying a household employee has unique requirements. You likely only employ a few employees, at most. Household payroll services help families pay household employees (using checks and direct deposits) and taxes.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2020 , Whether You Pay Someone To Care For An Aging Parent, Watch Your Children Or Handle The *If You Employ A Nanny Or Household Employee In The State Of California, Discovery Payroll Only Supports Employers Who Are Designated As Quarterly.

Employee Payroll Calculator. Household employers have different payroll needs compared to traditional businesses. Pay with direct deposit or. I've kept this spreadsheet fairly basic, so depending on your business and policies, you may find that you need to add more. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant or online payroll service (like intuit.com or paychex.com). To your employees, payday is always an important day. Household payroll services help families pay household employees (using checks and direct deposits) and taxes. We evaluated a dozen services based on their cost, expertise, and ease of use and. Providing pay and salaries on time is essential to maintain you can use a spreadsheet to calculate many of the amount values needed for payroll rather easily. For example, if you pay a person more than $2,100 a year or more than $1,000 per calendar stay current with irs and state regulations: Finally, the household payroll service you select should offer the ability to pay workers via. Paying a household employee has unique requirements. You likely only employ a few employees, at most. For instance, to calculate the total gross pay for. We stay current on all household employee payroll laws, so you don't have to. Mobile access makes paying employees an even simpler process.